While challenges remain, including rising costs and global economic uncertainties, the UK’s export trade environment is set for significant transformation, driven by infrastructure investments, regulatory updates, and evolving international partnerships.

Chancellor Rachel Reeves has outlined ambitious plans to boost growth, focusing on airport expansions, international trade missions, and economic cooperation with key partners. These initiatives come as Europe faces economic headwinds, underscored by a recent interest rate cut by the European Central Bank.

Infrastructure expansion to boost trade

Reeves has signalled strong government support for expanding the UK’s aviation infrastructure, including at Heathrow, recognising its critical role in trade and connectivity.

The government is considering further development at Luton and Gatwick airports, in addition to backing expansion at London City and Stansted. The proposed reopening of Doncaster Sheffield Airport and the establishment of an advanced manufacturing and logistics park at Manchester Airport are expected to generate significant investment and job creation.

“A third runway at Heathrow should be a priority,” said Marco Forgione, director general of the Chartered Institute of Export & International Trade. “We also urge the government to invest in the UK’s broader infrastructure network, including road, rail, and ports, to remain competitive in the global market.”

Strengthening global trade ties

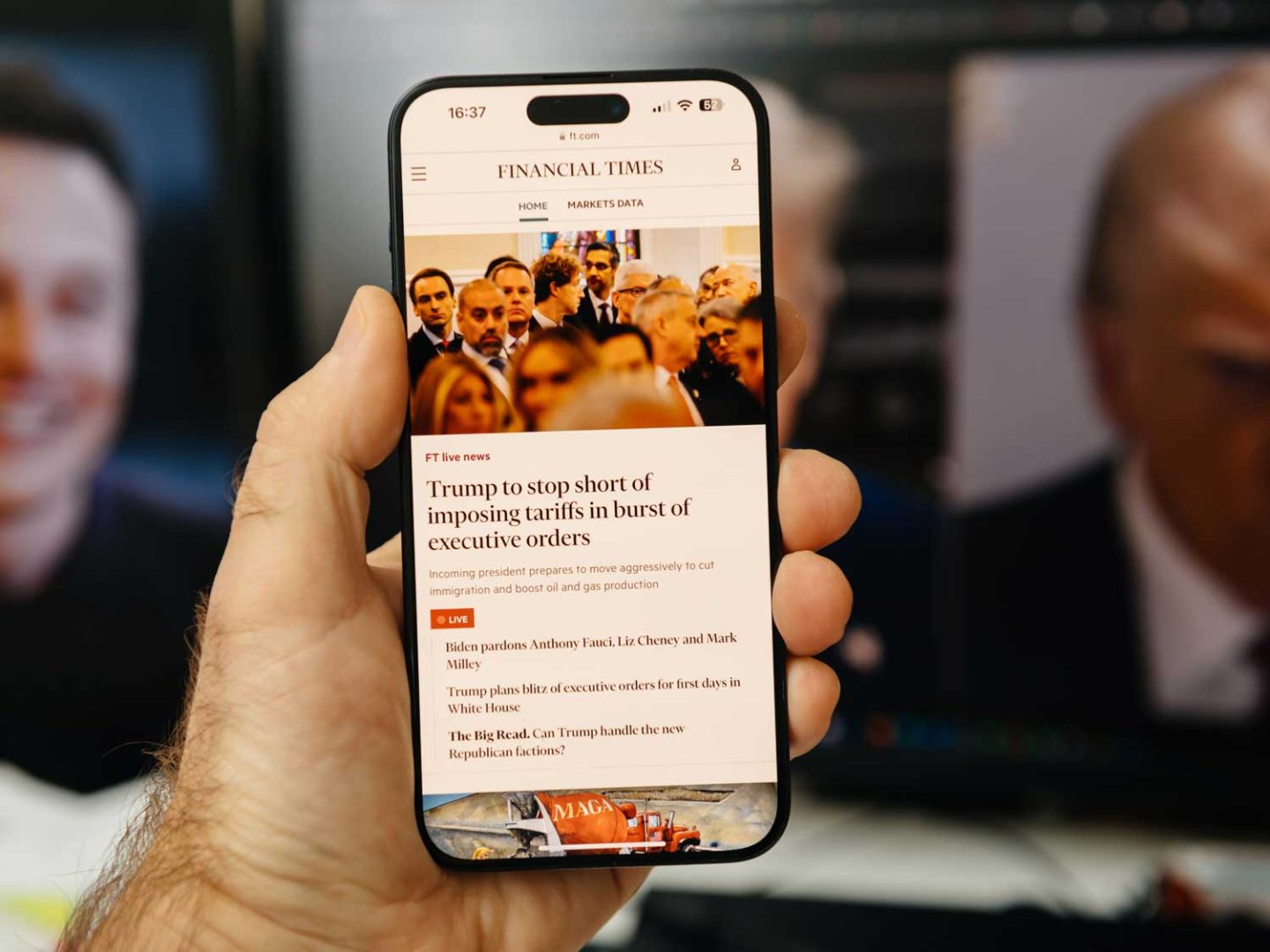

The UK government is ramping up efforts to strengthen international trade relationships. Business and trade secretary Jonathan Reynolds will lead a trade delegation to India next month, aiming to secure new partnerships and investment opportunities. Reeves also reaffirmed the UK’s commitment to leveraging its “special relationship” with the US, particularly under the administration of President Trump.

Meanwhile, China is solidifying its dominance in clean energy mineral supply chains, issuing loans worth billions to developing countries. This move highlights the urgency for the UK to secure its own critical mineral supply chains to support green energy initiatives.

Customs and regulatory updates

Changes in trade regulations continue to impact UK exporters. HMRC has announced the closure of the Modernising Authorisations project following a spending review. However, ongoing improvements to customs guidance and technical handbooks will still be delivered, ensuring businesses receive the necessary support for compliance.

Additionally, new safety and security requirements have been implemented, alongside updates to the Customs Declaration Service. These regulatory shifts reinforce the importance of businesses staying informed and adapting to evolving trade procedures.

UK-EU economic cooperation

The UK is pursuing deeper economic cooperation with the EU, with a proposal to link the UK and EU Emissions Trading Schemes (ETS). This alignment could help streamline cross-border trade and reduce compliance burdens when both parties fully implement their respective Carbon Border Adjustment Mechanisms (CBAMs). These mechanisms, designed to tax high-emission imports, aim to prevent carbon leakage by discouraging companies from relocating polluting activities to regions with looser environmental regulations.

EU officials have confirmed that the UK has requested ETS linkage and CBAM discussions to be included in an upcoming UK-EU summit. Minister for EU relations Nick Thomas-Symonds described this as an “absolute priority” for ensuring regulatory alignment and minimising trade disruptions.

Navigating the complexities of international trade requires real-time insights and expert guidance. At Metro, we continuously monitor market influences, including currency fluctuations, macroeconomic trends, and evolving regulations, to help you de-risk your supply chain and maximise opportunities.

Our MVT supply chain platform offers in-depth reporting, tracking global CO2 emissions and providing essential environmental compliance templates. Whether you’re entering new export markets, sourcing from fresh suppliers, or responding to regulatory changes, we provide tailored solutions to keep your business competitive.

With over 40 years of expertise in multimodal transport and customs brokerage, we lead the way with CuDoS, our automated customs declaration platform, ensuring swift compliance with UK and EU trade regimes.

Make informed decisions with Metro’s strategic support. For trade insights and risk management advice, EMAIL Laurence Burford, Chief Financial Officer. For customs and regulatory solutions, EMAIL Andrew Smith, Managing Director.