The Labour party’s manifesto outlines a commitment to bolster the resilience of supply chains in key sectors, a task that Transport Secretary Louise Haigh will spearhead.

Recent global events, such as the war in Ukraine and pandemic-induced disruptions, have underscored the necessity of this mission. These crises have driven up energy prices and disrupted the supply of critical goods, exacerbating inflation.

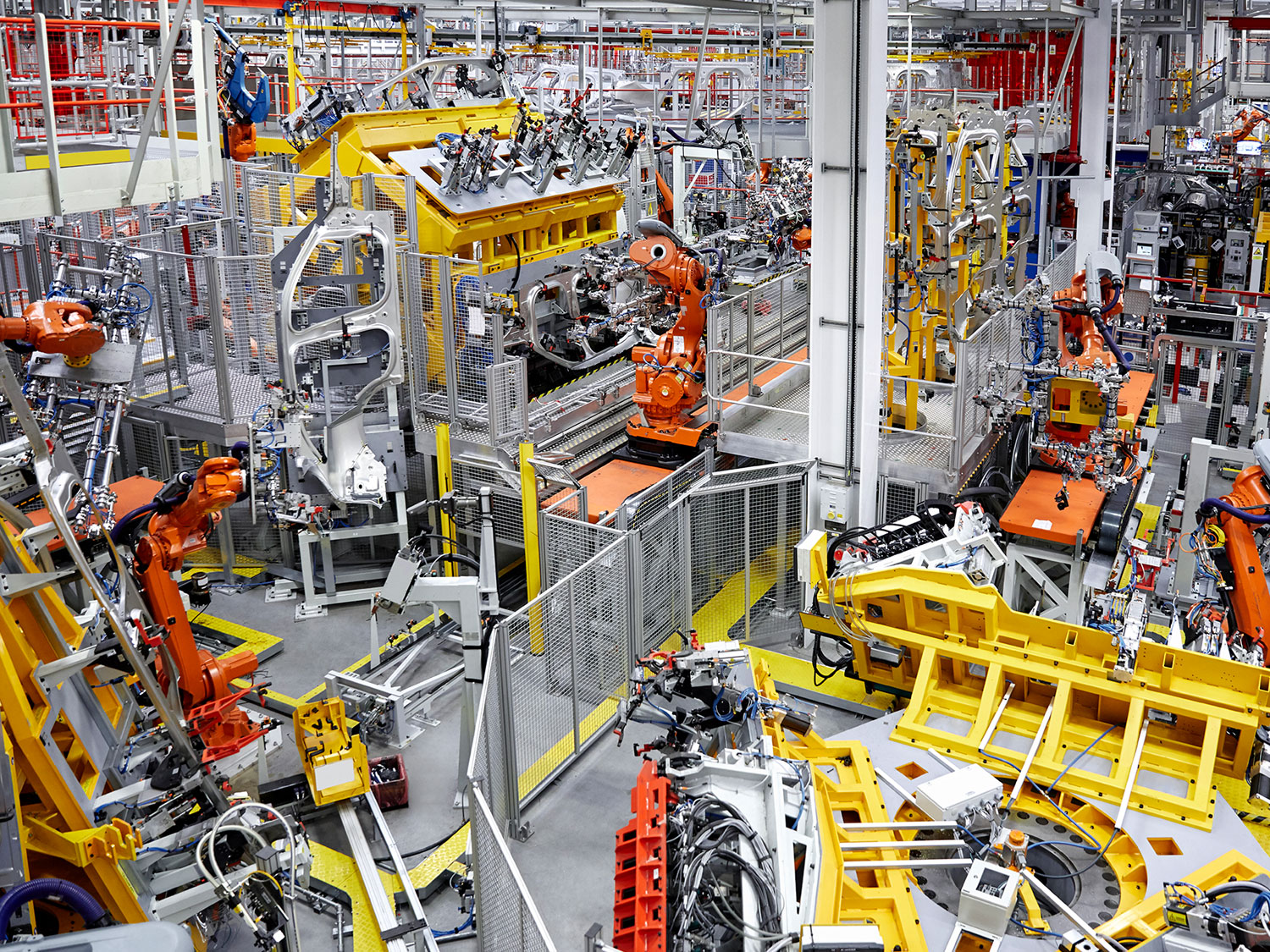

Enhancing supply chain resilience not only mitigates risks but also presents growth opportunities and as the world faces more frequent external shocks, a resilient supply chain becomes crucial to safeguard the economy, because vulnerabilities can halt or divert production.

Labour’s plan includes several key policies to strengthen supply chains:

- Investing £1.8 billion to upgrade ports and build supply chains across the UK

- Ensuring a robust defence sector and resilient supply chains through long-term business-government partnerships

- Maximising the economic and security potential of AUKUS, the trilateral security partnership with Australia and the US

- Adopting a strategic approach to managing UK-China relations

- Striking targeted trade agreements aligned with the UK’s industrial strategy

- Leading international efforts to modernise trade rules and agreements, promoting deeper cooperation through organisations like the WTO and CPTPP

- Seeking a new strategic partnership with India, including a free trade agreement, and enhancing cooperation with Gulf partners on security, energy, and trade

The government will work with international partners to align capacities in key sectors and advance international standards for supply chain diversification. Labour’s plan includes creating a Cabinet Subcommittee on National Resilience, conducting a COBRA review, and appointing a Minister for Resilience to coordinate responses.

Looking to a New EU Relationship

Labour’s manifesto also includes policies to improve the UK’s trade and investment relationship with the EU, which includes negotiating a veterinary agreement to reduce border checks and lower food costs.

Upcoming EU legislation, such as the Corporate Sustainability Reporting Directive (CSRD) and the Corporate Sustainability Due Diligence Directive (CSDDD), will impact UK companies. These regulations will require companies to disclose data on suppliers and emissions, impacting those with substantial EU activity or those part of the EU value chain.

For example, a UK auto parts manufacturer selling to an EU car company will need to comply with these directives. Labour’s approach aims to remove unnecessary trade barriers and improve economic cooperation with the EU, ensuring UK businesses remain competitive and compliant with new regulations.

For over 40 years Metro has been providing stable and effective solutions for customers entering new export markets, or sourcing from new suppliers.

Supporting their regulatory compliance and finance requirements, with multi-modal transport services and guidance on insurance and packing, to protect their products.

Our MVT supply chain platform incorporates a suite of reporting modules, including the tracking of global CO2 emissions and templates for CSRD reporting.

If you have any questions, rate requests or would like further information on our global export capability, please EMAIL our Chief Commercial Officer, Andy Smith.