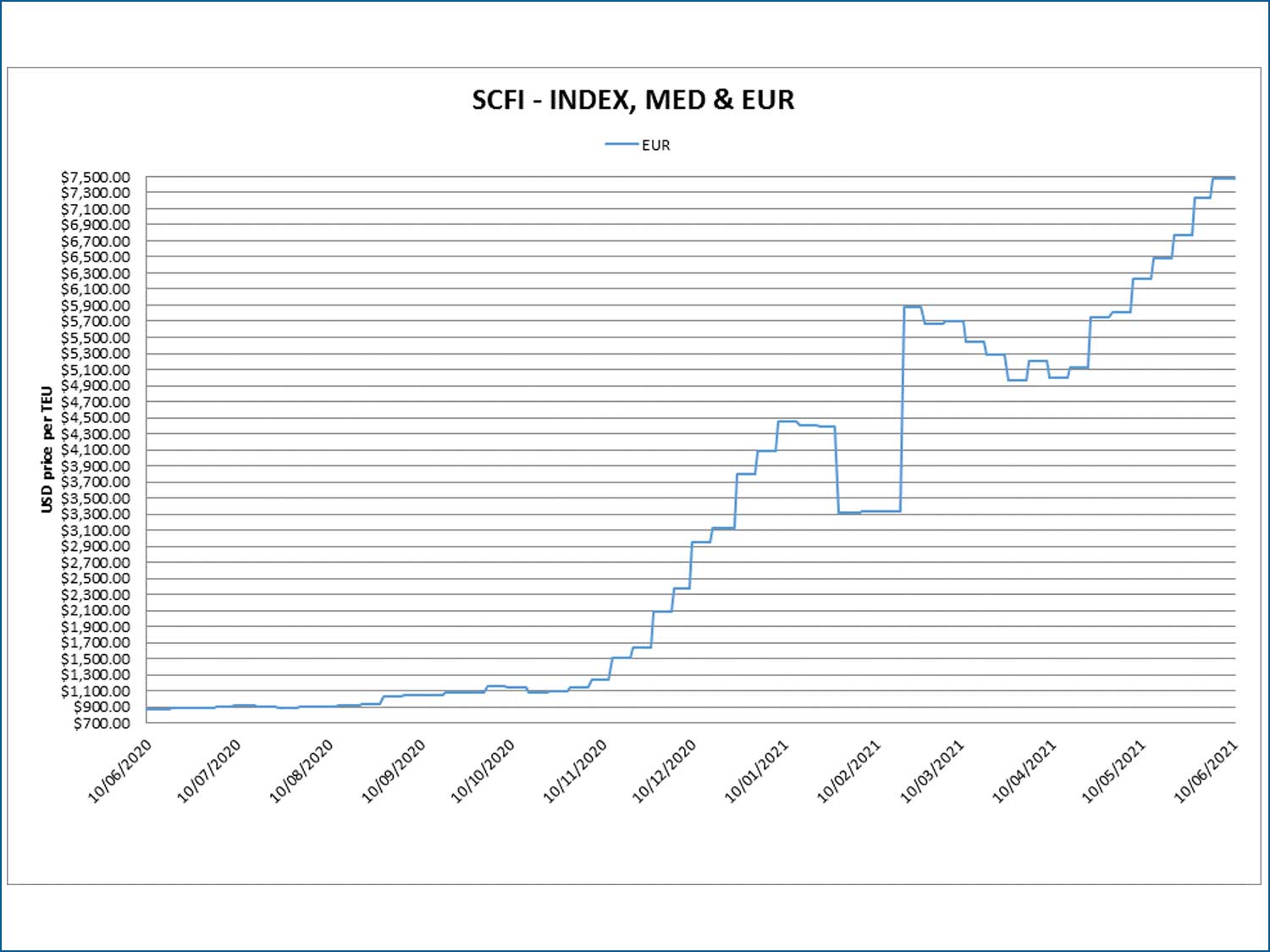

Monitored ocean Freight all Kinds (FAK) rates rose yet again this week from their already record-high levels, across all major East-West trades, up 518% on their level a year ago into Northern Europe and expected to remain on the higher side due to port congestion, huge demand and lack of equipment availability.

Shippers from Asia are bracing for imminent General Rate Increases (GRIs), and demand and capacity constraints mean that transatlantic shippers are also likely to see GRI premiums on top of elevated rates to secure space. This situation is actually being emulated in most regions globally and is not localised to Europe and the UK, as the carriers select the most lucrative routes and lanes to deploy their assets.

The impact of the market’s inflated pricing means that a number of critical commodities such as furniture and large electrical and electronic appliances risk being ‘priced out’ of ocean freight access to international vendors and factories. And that’s without the global consumer demand leading to inflation on many products and resources creating short supply of products, components and raw materials.

Research by Sea Intelligence suggested that one of the worst impacted cargo commodities is assembled furniture, where the freight rate now accounts for up to 62% of the retail value of the goods, and appliances, where the freight spot rate now accounts for up to 41% of the retail value for large appliances and up to 27% of the retail value for small appliances.

Some smaller businesses are struggling with the current supply chain disruption or simply being priced out of landing their goods and materials. Items like camping equipment have seen a spike in demand as families look to domestic holidays, but since many products are manufactured in China, there are shortages in the supply chains. As advised last week China is now the UK’s largest import trading region by some way with reliance, it would seem, on products that are fabricated and emanating from ‘the worlds factory’.

One outdoor equipment retailer is still waiting on orders placed in October and has nine containers of outdoor clothing, camping gear and hiking equipment stuck in Egypt as a result of the Suez Canal blockage.

It is very clear that we are now at a point where an increasing range of cargo commodity owners will struggle to maintain margins that will sustain their business, at the currently high freight rates.

Difficult choices need to be made in passing the elevated costs on to consumers, or waiting for rates to cool down, with the ever-present risk of losing business. Inflation looks set to continue to increase and not just a result of the cost of freight, although freight inflation of costs rise is likely to be unstoppable in the short term.

Rates keep climbing because demand and volumes have continued to stay at peak levels, and the delays that those volumes have created, in turn reduce capacity by tying up ships and containers at congested ports. This is all before the ‘traditional’ peak season expected in Q3/Q4 are factored into the supply chain equation.

So far this year carriers have cancelled the same percentage of Asia-US West Coast sailings due to delays, as they did last year because of plummeting demand during the first months of the pandemic.

Metro negotiate rate and volume agreements with a wide range of carriers across all three alliances, which means we can access the widest pool of equipment and offer shippers the biggest range of service offerings, port-pairings and rates.

Our fixed validity contracts provide supply chain security and peace of mind, but with space and equipment in such short supply, we recommend a minimum of four weeks visibility and booking window, to secure space on the vessel and get the right equipment positioned.

Please contact Elliot Carlile or Grant Liddell to learn how we can support your supply chains, even in the most challenging market conditions.