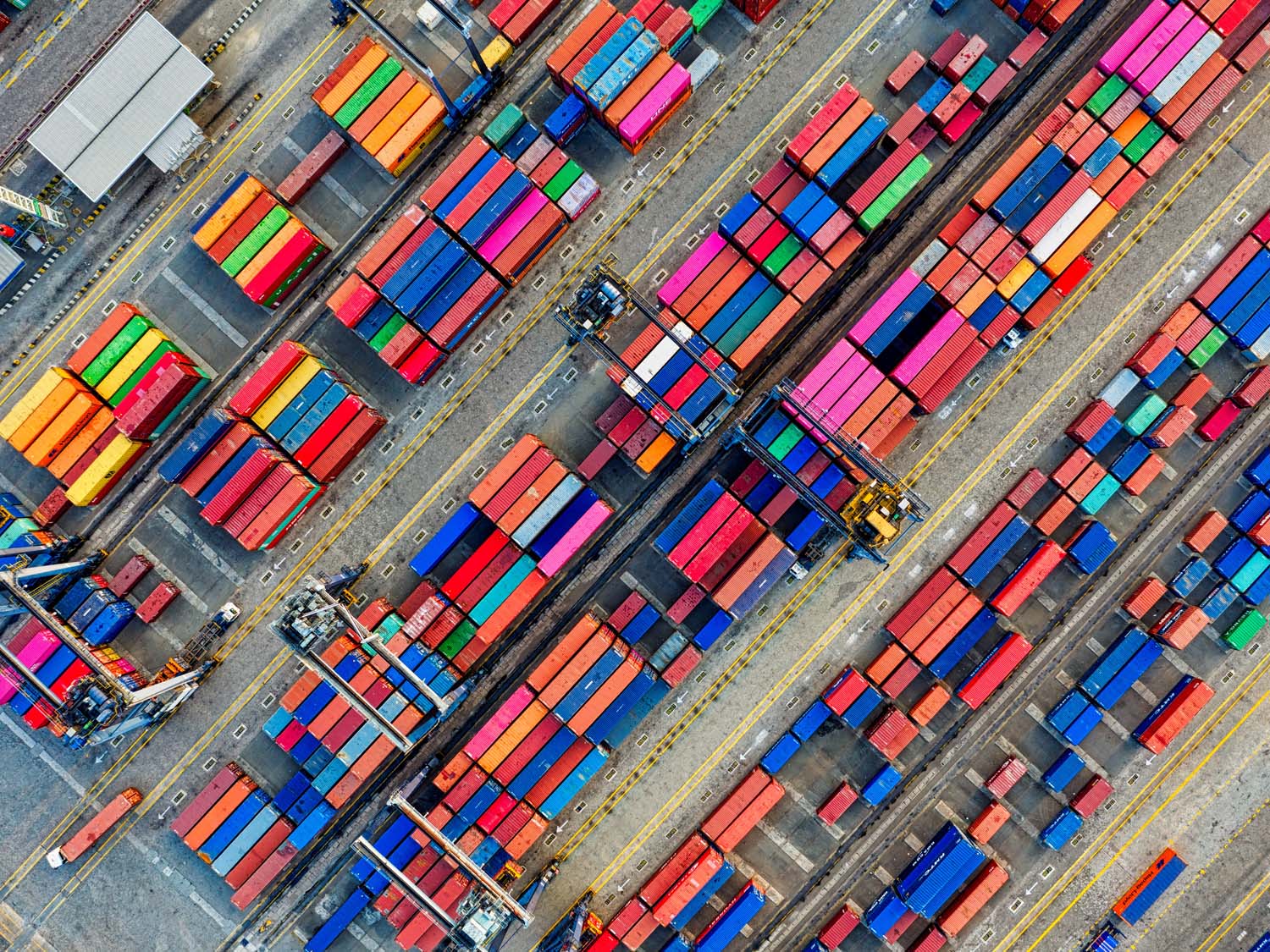

When global supply chains finally start to return to some form of normality, which many hope to see in the second half of the year, carriers face more headaches, with an avalanche of empty containers predicted to cause chaos. Who would have thought it?

Full year 2021 demand for sea freight growth was 6.5% compared to 2020 and up by 5.3% compared to 2019, meaning an average annual growth rate of 2.6% compared to pre-pandemic 2019.

The problem in the supply chain is therefore not that of global demand, but the highly skewed nature of the global shipping market where we have seen super strong growth of imports from Asia to North America and consistent increases to Europe, but either slow output or outright declines on other trade lanes.

In 2021, overall demand was equivalent to loading (and shipping) 6 TEU every second throughout the year, but disruptions and bottlenecks in the supply chain during the pandemic have led to vessels being delayed for extended periods, which effectively reduces the amount of capacity in the market and increased the need for additional container capacity to be introduced.

Despite the introduction of millions of new and diverted containers, the gap between effective demand and available supply has been over 15% in the past year, which highlights the continuing challenge we face in positioning equipment in many origins.

We see the shortage of containers driven by three elements: onward intermodal connections; port and terminals; and shipping schedule considerations.

It is the consistent resolution of these problems, that will ultimately dictate how quickly the supply chain crisis is resolved, and consequently how long it will take for equipment availability to normalise. In the right place at the right time.

In short, until land-side issues are resolved and shipping schedules restored, there will be no let up on equipment availability pressures. The variables in shipping are intrinsically interwoven with resulting consequences that cause unrelated but direct issues to container movements.

But, when supply chains do finally start to shorten, it will release a large amount of empty containers, 3.5m TEU from the transpacific alone, which will potentially create a new wave of congestion problems in the second half of 2022 and in 2023, in terminals as well as container depots.

Carriers and container leasing companies need to start planning for this development, or the resolution of operational bottleneck problems will create a ripple effect, with the potential of overwhelming container depots in the US, Europe and globally, where cargo imbalances are experienced.

Supply chains have never faced so many challenges and with local conditions changing rapidly it is critical that you have the ability to react quickly to new challenges – like a deluge of empty containers creating unexpected bottlenecks.

Our MVT supply chain platform gives you the power to improve your supply chain resilience across five key areas:

PERCEPTION – With a thorough understanding of our customers’ requirements and objectives we create supply chain solutions that draw on all options available in the current market.

VISIBILITY – Linking your supply chain participants and critical time-scaled events to provide end-to-end visibility across the extended supply network, with global control down to individual SKU level.

AGILITY – Proactively managing your supply chain flow means slower moving lines from any origin can be deferred, while priority orders can be highlighted and expedited, to increase speed to market and accelerate the cash-to-cash cycle.

FLEXIBILITY – It is simple to change supply lines, adding and monitoring new vendors, product flows and outbound order data, from any location.

CONTINGENCY – MVT’s exception alerts and rules-based solutions, correct operational non-conformities, without human intervention, or alert users to issues outside set-parameters for corrective action.

For specific information, or to discuss how our technology could support your supply chain, please contact Simon George our Technical Solutions Director or Elliot Carlile.